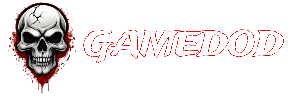

Bitcoin price recently reached a record high of $71,000, driven by growing optimism over Bitcoin Exchange-Traded Funds (ETFs) and signals from the Federal Reserve on interest rates. As investors eagerly watch for more gains, Bitcoin’s price increase hints at strong future potential. Here, we break down the factors boosting BTC’s momentum and what might come next.

Spot Bitcoin ETFs Could Transform the Market

One of the main drivers behind Bitcoin price growth is the likely approval of spot Bitcoin ETFs in the U.S. The U.S. Securities and Exchange Commission (SEC) is currently reviewing several applications, and many experts expect an approval soon. Spot ETFs give direct exposure to Bitcoin instead of futures, opening the door for a broader audience, including institutional investors, to easily invest through traditional brokerage accounts.

These ETFs could boost Bitcoin price by introducing fresh demand, increasing stability in the cryptocurrency market, and establishing Bitcoin as a mainstream asset.

Federal Reserve’s Potential Interest Rate Shift Impacts Bitcoin Price

Another factor impacting the BTC price surge is speculation on the Federal Reserve’s interest rate policy. After months of rate hikes, there are growing expectations that the Fed may pivot to rate cuts in the near future. Lower interest rates generally boost assets like Bitcoin, as they lower borrowing costs and drive investors toward alternative investments.

Many see Bitcoin as a hedge against inflation, and a rate cut could attract even more institutional interest in Bitcoin, adding to its price momentum.

Analysts Predict Further Bitcoin Price Increases

With Bitcoin’s current upward trend, analysts are making positive predictions. Bitfinex experts recently projected that BTC price could surpass $80,000 by the end of 2025, thanks to strong activity in the futures and options markets. Increased ETF inflows and consistent interest from investors support this outlook.

Bitcoin’s limited supply—capped at 21 million coins—also plays a key role. As adoption grows and demand rises, Bitcoin’s scarcity effect may push prices even higher.

What’s Next for Bitcoin Price?

The immediate future of Bitcoin price will largely depend on the SEC’s spot ETF decision and the Federal Reserve’s rate policies. Investors are watching closely, as regulatory or economic shifts could impact the cryptocurrency market significantly.

Bitcoin’s recent performance underscores its resilience and growing appeal as an investment. As interest in cryptocurrencies expands, BTC price may continue on an upward path, promising new opportunities for both experienced investors and newcomers.